The Of Palau Chamber Of Commerce

Table of ContentsPalau Chamber Of Commerce Fundamentals ExplainedThe Only Guide for Palau Chamber Of CommerceSome Of Palau Chamber Of CommerceAll about Palau Chamber Of CommerceThe 8-Minute Rule for Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For AnyoneUnknown Facts About Palau Chamber Of CommerceHow Palau Chamber Of Commerce can Save You Time, Stress, and Money.

Our Palau Chamber Of Commerce Diaries

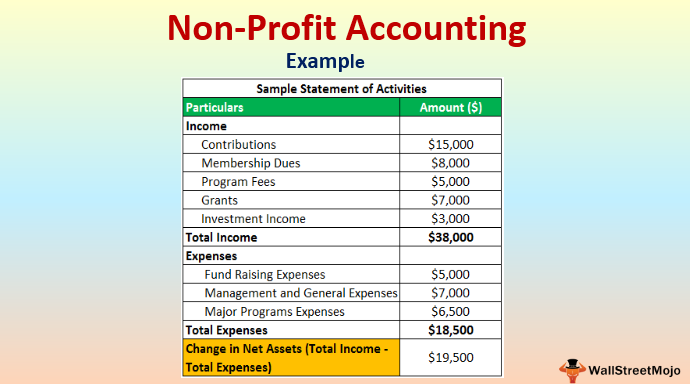

donation size, dimension the donation was contribution, who donated, gave away muchJust how how they just how to your website, etc) And so on, lastly pages make web pages convenient and practical for your donors to benefactors!

Be sure to collect e-mail addresses and various other pertinent data in a correct way from the start. 5 Take treatment of your individuals If you haven't taken on hiring as well as onboarding yet, no worries; now is the time.

There are many donation software available, and also not using one can make on the internet fundraising fairly inefficient or even difficult. It is essential to select one that is simple for you to set up and also manage, is within your budget plan, and also offers a smooth donation experience to your contributors. Donorbox is one of the most budget friendly donation platform out there, charging a little platform charge of 1.

Palau Chamber Of Commerce Fundamentals Explained

To discover a lot more, take a look at our post that talks even more extensive regarding the major not-for-profit funding sources. 9. 7 Crowdfunding Crowdfunding has ended up being one of the important ways to fundraise in 2021. Because of this, nonprofit crowdfunding is ordering the eyeballs nowadays. It can be made use of for specific programs within the organization or a general donation to the cause.

During this step, you could desire to believe about milestones that will certainly suggest a chance to scale your nonprofit. As soon as you have actually operated for a bit, it's vital to take some time to assume about concrete development objectives.

The Buzz on Palau Chamber Of Commerce

Without them, it will certainly be tough to examine as well as track development in the future as you will certainly have absolutely nothing to gauge your outcomes against and also you won't know what 'effective' is to your nonprofit. Resources on Starting a Nonprofit in various states in the US: Starting a Not-for-profit Frequently Asked Questions 1 - Palau Chamber of Commerce. How a lot does it cost to begin a not-for-profit company? You can start a not-for-profit organization with an investment of $750 at a bare minimum and it can go as high as $2000.

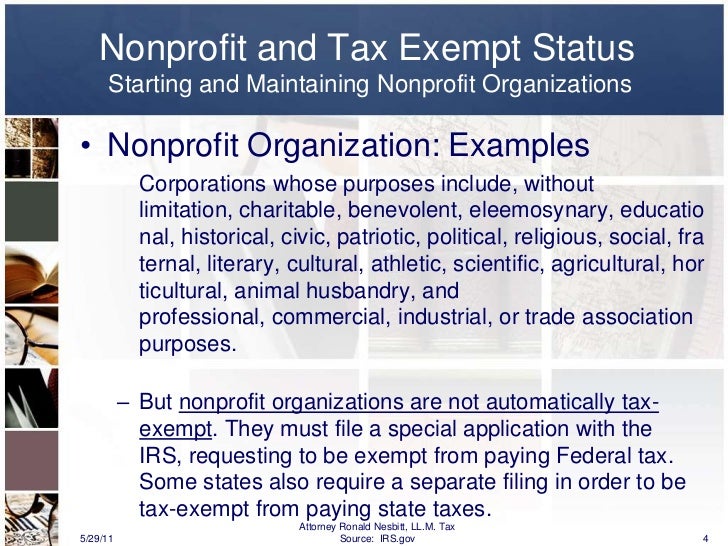

For how long does it require to set up a not-for-profit? Depending on the state that you're in, having Articles of Incorporation authorized by the state federal government may occupy to a couple of weeks. As soon as that's done, you'll need to request acknowledgment of its 501(c)( 3) condition by the Irs.

With the 1023-EZ kind, the handling time is commonly 2-3 weeks. 4. Can you be an LLC and also a nonprofit? LLC can exist as a not-for-profit minimal liability company, nonetheless, it should be entirely owned by you can check here a single tax-exempt not-for-profit company. Thee LLC need to likewise fulfill the demands according to the internal revenue service required for Minimal Obligation Companies as Exempt Company Update - Palau Chamber of Commerce.

Palau Chamber Of Commerce Can Be Fun For Anyone

What is the difference in between a structure and a not-for-profit? Foundations are normally funded by a family or a corporate entity, however nonprofits are funded with their incomes and fundraising. Structures generally take the money they started with, spend it, and after that distribute the cash made from those investments.

Whereas, the extra money a not-for-profit makes are used as running prices to fund the company's goal. Is it hard to start a nonprofit company?

There are a number of steps to start a not-for-profit, the obstacles to entry are fairly few. Do nonprofits pay taxes? If your nonprofit makes any type go right here of earnings from unassociated activities, it will certainly owe earnings tax obligations on that amount.

Palau Chamber Of Commerce - The Facts

The role of a not-for-profit organization has actually always been to create social modification and lead the method to a much better world., we focus on solutions that aid our nonprofits enhance their contributions.

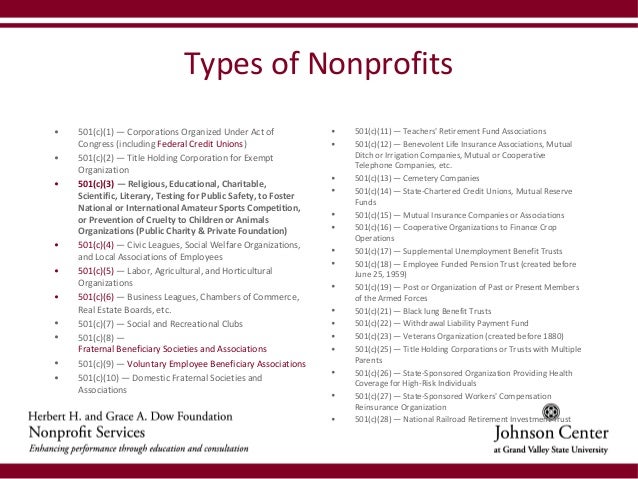

By much the most usual type of nonprofits are Section 501(c)( 3) companies; (Area 501(c)( 3) is the component of the tax code that licenses such nonprofits). These are nonprofits whose goal is philanthropic, religious, instructional, or scientific.

This category is important since private foundations are subject to stringent operating policies and also guidelines that do not relate to public charities. For instance, deductibility of payments to a personal structure is extra limited than for a public charity, as well as personal structures go through excise tax obligations that are not troubled public charities.

The Main Principles Of Palau Chamber Of Commerce

The bottom line is that personal foundations get a lot worse tax obligation treatment than public charities. The main distinction between exclusive foundations as well as public charities is where they get their economic support. A personal foundation is usually controlled by an individual, family, or corporation, and acquires most of its revenue from a couple of contributors and financial investments-- a great example is the Expense and also Melinda Gates Foundation.

This is why the tax obligation regulation is so difficult on them. The majority of foundations simply give cash to other nonprofits. Somecalled "running foundations"run their own programs. As a sensible matter, you require a minimum of $1 million to begin a personal foundation; otherwise, it's unworthy the trouble and also expense. It's not shocking, then, that an exclusive foundation has actually been described as a big body of cash surrounded by individuals that want several of it.

Various other nonprofits are not so lucky. The IRS originally presumes that they are personal structures. Palau Chamber of Commerce. Nonetheless, a new 501(c)( 3) company will certainly be classified as a public charity (not a personal structure) when it gets tax-exempt status if it can show that it fairly can be anticipated to be openly supported.

Getting The Palau Chamber Of Commerce To Work

If the IRS categorizes the not-for-profit as a public charity, it keeps this condition for its first five years, no matter of the general public assistance it really gets during this time around. Beginning with the not-for-profit's 6th tax obligation year, it needs to show that it satisfies the public assistance examination, which is based on the support it receives throughout the present year as well as previous four years.